BEADLE CHEVROLET GMC MOBRIDGE

BEADLE SALES FORD/LINCOLN MOBRIDGE

FAULKTON

BEADLE's AUTO

BEADLE FORD & CHRYSLER BOWDLE

Send Us a Text

Use the form below to send us a text.

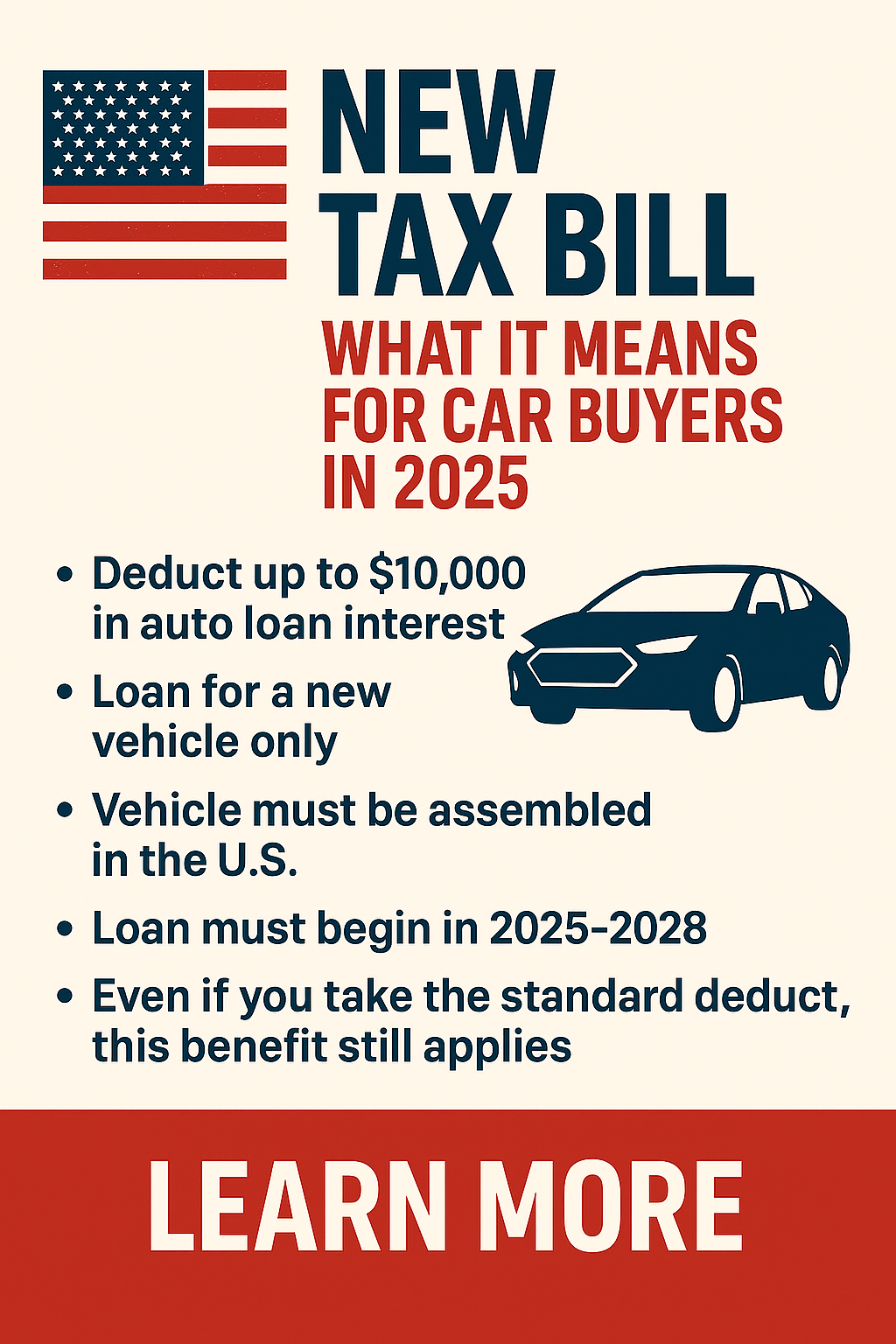

In 2025, a new law bill was signed to give car buyers a break. If you’re buying a new vehicle that’s assembled in the United States and you finance it, you could deduct up to $10,000 in auto loan interest on your taxes each year.

Even if you take the standard deduction, this benefit still applies. That’s huge!

Most everyday buyers do—but there are income limits. If your income is under $100,000 (single) or $200,000 (joint), you get the full benefit. If you make more, it phases out slowly.

If you finance a new car and pay interest, the average buyer could save $400–$500 or more on their tax return just in the first year.

Only new U.S.-assembled vehicles qualify. We’ve made it easy—click below to view eligible vehicles.

If you're shopping for an EV, act fast! The $7,500 federal EV tax credit ends on September 30, 2025. That means now is the perfect time to stack your savings while it's still available.

We’re here to make things easy. Our finance team will help you understand your options and get the most from every incentive. We carry new Chevrolet, GMC, Ford, Lincoln, Chrysler, Dodge, Jeep, and Ram vehicles—many of which qualify for this tax break.

This blog is for informational purposes only. Please consult your tax professional for personal tax advice.